So you've decided to start a business - maybe you alone have an awesome idea, or maybe you and some friends, or you and your partner have decided to pool your resources and skills into a *big* awesome idea.

But the first hurdle can look the biggest - how do I even get started? Should we be a company? How does sole-trading work? What happens if I go belly up? What happens if I succeed so much that I'm paying HUGE taxes?

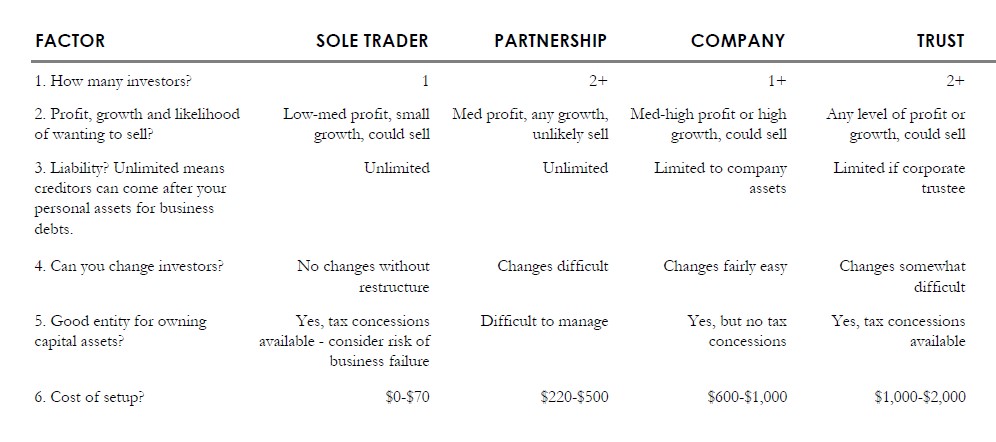

In this article (which is the first of a series) I'm going to outline the main structures you can choose from, and who they are and aren't suitable for. I'm also going to outline the factors you should consider when deciding between structures. If you want to skip ahead, there's a table at the end comparing all the factors across all the structures.

What are the main business structures?

There are four main structures that represent probably 95%+ of the small businesses in Australia:

- Sole Trader

- Partnership

- Company

- Trust

Each of these has their own pros and cons depending on your specific needs - but before we get to that, let's understand what they are.

Sole Trader

A sole trader is basically an individual who has applied for an ABN. All of the business income applies only to the sole trader, and the income is taxed at individual tax rates (along with any other income the individual earns).

Sole trading is quick and easy to set up (with the only potential cost being the registration of a business name - from as little as $30) and easy to account for - you don't have to worry about 'paying yourself wages' or tax withholdings - all you have to do is track your income and expenses, and make sure to save some up for your income taxes.

Sole trading also comes with some downsides - the main one being that sole traders have 'unlimited liability'. Unlimited liability means that if the business goes bust and cannot pay its debts, the creditors can come after the other income and assets of the individual - for example, if you own your own home, and your small business goes under, the creditors may legally be able to force you to sell the home in order to pay your debts.

You cannot easily bring on business partners without restructuring, and you are subject to the individual marginal tax rates - this can be a blessing and a curse. If your income is quite low, you will get the tax free threshold, and a low tax right right through $37,000. However if you're employed in another job, your business income is essentially added on top of your other income - sometimes leading to effective tax rates of 34.5% or 39%.

While some industries or people can claim sole trader business losses as a reduction against their other taxable income, most people's sole trader business losses are quarantined and carried forward to be offset against future business gains.

Partnerships

Partnerships are similar to sole traders in many ways, except that of course they include 2 or more people in the business arrangement.

Partnerships are also relatively easy to set up, however it is strongly recommended to get a partnership agreement - this is likely to cost over $200 at a minimum, as well as the cost of registering a business name.

A partnership agreement allows the partners to confirm the terms of their business arrangement, as well as the income entitlements. Partners in a partnership are equally entitled to their proportion of any losses as they are to any income - this is particularly useful for operations such as farms, where losses can be a common occurrence.

Partners cannot receive a salary or wage - any payments for their services are considered to be drawings against their partnership income. As a result, the agreed income entitlements should factor in the value of the time/work put in by each partner, as well as their investment.

Partnerships have many of the same downsides as sole traders - unlimited liability being the largest. In a partnership this liability becomes even larger - every partner is jointly and severally liable for all payables of the partnership. What that means is, your liability is not restricted to your 'share' of the partnership - if you hold enough assets, you may be required to repay all the partnership's debts even if you only hold a small share in the business.

Each partner's share of the profits is taxed separately - so each partner's tax liability will differ based on their other circumstances.

If the partnership makes a loss, the individual partners may not be able to offset that against their other taxable income - like sole traders, partnership losses are often quarantined and carried forward.

Companies

Companies are the business entity of choice for those who think their business is going to be pretty serious. They are the only business entity that is taxed separately - companies are taxed in their own right and are not required to 'stream' their income anywhere.

Companies offer many benefits for business partners who want to be above board and feel safe - they are regulated by and registered with ASIC, which also means it's easy to change your details or find forms to make changes as required.

They also have one universal tax rate for any value of profit - if the total income is less than $10m, it is taxed at 27.5%, otherwise at 30%. This makes it easy to calculate and forecast tax liability for companies.

But the biggest benefit of companies - particularly in comparison to sole traders and partnerships - is that they have limited liability. What that means is, provided the company's owners and directors have not acted fraudulently - if the company goes bust, the creditors can only draw on the company's assets to fund repayments, they cannot go after the personal assets of the directors or shareholders.

Companies are a bit more expensive to set up - the fees to register the company with ASIC run at a minimum $500, and there is an annual $300 fee to keep the company registered. In addition you might have accountant or legal fees as you go about the set-up process.

Unlike partnerships, companies can pay salaries or wages to their directors and shareholders - so the ownership percentages tend to be based on the level of investment - whether direct cash investment, or by applying an ownership percentage to a person's skills, know-how or idea - the intangibles.

Company losses are quarantined in the company - this means that they stay there until the company makes an eventual profit to use up the losses.

Trusts

It is my personal opinion that trusts add unnecessary complexity to business arrangements, and are better used to invest in the business itself (eg as a shareholder of a company). People like the idea of trusts because you can stream the income out in a variety of ways to minimise the overall tax position of the business and its owners - however I find you can usually get to a similar level of benefit by setting up a company with the right ownership structure, and removing various levels of complexity.

However, there is a place for trusts in some kinds of business arrangements - most notably where the business is going to hold any sort of non-depreciable property or asset. If you buy an actual premises (a house or warehouse), or if you intend to use the business to invest in other businesses (buying shares in other businesses, or structuring several layers of subsidiaries), these are non-depreciable assets - their value is carried on your books until you sell the asset, and they are then subject to Capital Gains Tax rules rather than regular income tax rules.

Trusts are able to stream their capital gains out to the beneficiaries of the trust - and if this is streamed out to individuals, the capital gains are eligible for a 50% discount - so you will only pay tax on 50% of the gain on sale of these assets.

Companies are not eligible for any capital gains discounts, so they pay tax on 100% of the gain on sale of non-depreciable assets.

If you do choose to run your business through a trust, there are two main forms it can take:

- a unit trust, where each investor owns a particular number of units, and is entitled to proportional income accordingly (best for unrelated or multiple investors)

- a discretionary trust, where the profits can be streamed at the discretion of the trustee (this is used to stream income to family or partners, as well as related companies, to minimise the overall tax payable each year)

Setting up a trust is generally the most expensive form of starting a business - as well as the cost of the trust deed itself (probably around $500-1,000), it's also recommended to set up a trustee company to protect the business owners' personal assets (another $500+), and you'll likely need to consult accountants or lawyers to discuss and confirm the structure.

Like companies, losses are quarantined inside trusts until there is enough profit to use up the losses.

Trusts can also pay wages to beneficiaries just like companies can, so there is no need to structure the investment to reward 'work' done in the business - wages can be paid to reflect that.

Meme Break

I imagine you're feeling a bit of information overload at the moment, so let's take a minute to have a meme break. Remember, there's a summary table at the end of this article that summarises everything I've just said, and everything after the meme break.

What should I consider when I'm choosing my business structure?

There's a myriad of things that might be a factor in choosing your business structure, but I've outlined the most important ones below:

1. How many people will be involved? Just you, or you plus other business partners?

If it's just you, you're probably best being a sole trader or company. If there's more than one business partner, a partnership, company or trust will all work.

2. How big do you expect your business to be?

Are you intending to build it up to a point where you need to employ staff? Are you intending to grow and then sell the business? What are your estimated gross income and profit figures for the first few years? Are you intending or expecting to quickly reach the point where being taxed individually would be an exorbitant tax rate?

If you're looking to grow rapidly, employ staff etc, it may be best to structure as a company from the start, to avoid the cost and issue of restructuring just a couple of years down the track.

If you're looking to sell, most structures will work - however some of them (like partnerships) make reporting more difficult when you're trying to present the 'picture' of how the business performs, for a potential buyer.

If your profit is estimated to be more than approx $100k, you should seriously look at setting up as a company to take advantage of the lower tax rate.

3. How likely is it that your business may go under?

If you're using the business predominantly to complete services (eg an accountant, a graphic designer etc) this risk is relatively low and you can easily set up as a sole trader or partnership if desired.

Hhowever if you're operating a retail shop or restaurant, or doing some sort of manufacturing or wholesaling, there is a higher risk of business collapse - consider the potential liability, and consider structuring as a company or trust to limit your liability.

4. How easily would you like to add or remove business partners moving forward?

If you're currently striking out alone, but envisioning expanding and bringing on other experts or investors in time, then structuring as a company makes it easier to issue equity to those investors when the times comes.

Similarly if you're expecting ongoing changes to your business ownership as investors come and go, a partnership is not the best structure - each change to the partners basically creates a new partnership. A company is a more flexible structure for these

purposes.

5. Are you intending to own capital assets? (property, shares etc - not plant and equipment)

If so, the best structures would be sole trader (if it's just you, and your liability risk is low), or trust (if your liability risk is high, or there are multiple business partners). Partnerships become extremely difficult to manage when asset ownership is involved, and companies cannot access the concessional treatment of capital gains that trusts and individuals receive.

6. How much are you willing to spend to establish your business?

Keep in mind - this is an important factor, but choosing the cheapest structure should not outweigh the potential liability risks or tax rate issues when you're setting up.

Summary Table

So there's a whole lot of information spread across a whole lot of words, right? But it basically comes down to the 4 possible entities, and the 6 main considerations, so I've built you a table!

Conclusions

This might seem like a pretty heavy, in depth article, but setting up your business - while definitely exciting - is a pretty in depth thing if you're planning to grow, bring on investors, or eventually sell on to someone else. Choosing the right structure now can save you thousands of dollars in taxes or restructure costs in the future.

If you have any questions or want to discuss your new business, you can contact me for specific advice, to get the ball rolling on the actual set up activities, or even just to talk through the options with specific reference to your needs.

If you'd like to make sure you don't miss a single post in my series about establishing your small business so that you hit the ground running, be sure to sign up for my Small Business Newsletter!