Australian student loans are an alphabet soup of acronyms - HECS, HELP, SSL, SFSS, TSL, FEE-HELP, VET-HELP, ABSTUDY, it's enough to make your head explode!

I'm here to clear away the smoke and mirrors, and shine light on the shroud of mystery surrounding student loan debts, answering some of the most common questions about how these interact with your taxes after you've finished your study. Let's start with the most common question I get from my clients:

Why do I see my employer taking out repayments every pay, but I never see the debt go down?

I probably get this question at least once a week - people see hundreds and even thousands of dollars of HELP and other student loan repayments being taken out of their wages, but they look on their My Gov account and never see the balance go down - why?

The basic answer is because even though you 'pay tax' every pay period - every week, fortnight or month - you don't actually officially pay tax to the ATO, or make a repayment on your HELP debt, until you lodge your tax return for that year. At the end of the year, all in a lump sum, the ATO will make the HELP repayment for the full year for you.

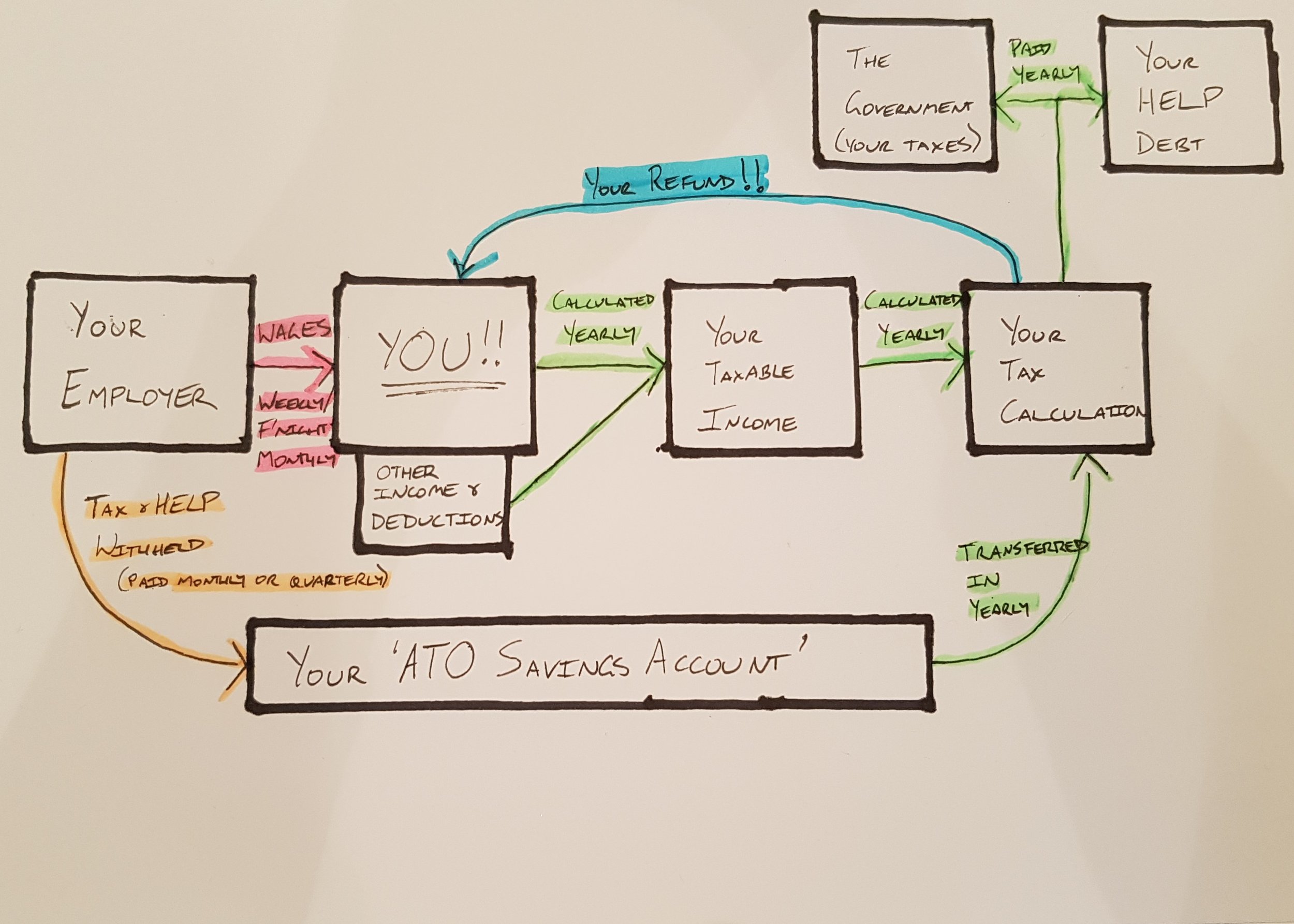

Clear as mud? Let's dive a bit deeper. Keep reading, and use the colour-coded diagram to follow along as well.

My marketing guru thinks a hand-drawn diagram is cute and quaint - I just hope it helps you understand what I'm getting at!

Each pay period, your employer withholds tax and HELP repayments from your wages. They calculate these using ATO guidance, based on the assumption that you will earn exactly that much every pay period for the financial year. The pink arrow is your pay periods - the most frequent part of the whole pay and tax cycle.

Every month or quarter, your employer pays the ATO all the taxes and repayments they've withheld from you - that's the orange arrow. All these payments are built up in your 'ATO savings account' - you can't access it (and neither can I), but it's an invisible account that builds up all your taxes for the year, ready to apply them to your tax return when you lodge it.

But until the end of the tax year no one - not even you - knows exactly what your taxable income is going to be. Until then everything is an estimate - including your loan repayments. Things like second jobs, small businesses and interest income can increase your taxable income above what your employer estimates, while deductions or negatively geared investments can decrease your taxable income - both of these have an effect on your actual tax and HELP loan payment amounts.

The green arrows only happen yearly - once a year, your taxable income is calculated. That's used to calculate how much you owe in tax and HELP payments. The ATO then draws on your invisible 'ATO Savings Account' and uses that to pay your HELP debt, pay the government your taxes - and if there's any left over, pay you your refund!

(I made the refund blue because it's clearly the most important bit).

It's like saving up to buy something new - week to week you might add amounts to your savings account, but it's not until you actually buy the computer that the money is spent. With taxes, your employer adds amounts to your 'ATO Savings Account', but it's not until you lodge your return once a year that you actually pay your taxes and HELP debt.

Example time!

Let's say your salary from your employer is $60,000 per year. Over the year, they've withheld exactly $14,547 from your salary - which includes $2,400 of HELP repayments withheld. Your invisible 'Tax Savings Account' has a balance of $14,547 in it, ready for you to lodge your tax return.

Now let's say you have $2,500 of tax deductions - now, for tax purposes, your taxable income isn't $60,000, it's actually $57,500. The ATO looks at this number and says 'okay - the tax on that is $11,247, and there'll be a HELP repayment of $2,300. That adds up to $13,547, and we have $14,547 saved up for you - that means you get a refund of $1,000.'

When you lodge the return, as well as getting your refund, the ATO then sends that money to your HELP account - so you'll see it drop by $2,300 overnight!

How much are the repayments, and when do they kick in?

There's a lot of different levels to this, so let me throw some images at you!

Student loan compulsory repayment thresholds and rates for 2017 and 2018 tax years - Source ATO Website

Basically - at the moment everything kicks in at $54,869 for the 2017 tax year, and $55,874 for the 2018 tax year.

I heard they were bringing in repayments at even lower income levels!

At the moment, there is already a 2% repayment legislated in the 2019 tax year (not effective until 1 July 2018) which will kick in at $51,957.

In May 2017, the government declared that they would be introducing a 1% repayment from income of $42,000, with 0.5% jumps at various income tiers beyond that. This would also apply only from the 2019 tax year onwards (commencing on 1 July 2018), but it's also important to note that this is not yet law. Odds are it will become law before 1 July 2018, but at the moment both the percentages and the thresholds are not yet set in stone.

Hopefully this has helped explain a little about how HELP and student loan repayments work, and why you don't see your employer's withholdings go onto your loan until after you lodge your tax return.

If you'd like some more detailed or specific advice for your situation, please contact me and we can book in an appointment or I can answer your question by e-mail.

If you'd like to stay up to date with my articles for individuals, sign up to my Tax Return Newsletter!