Ah, 30 June. The end of another tax year.

For some folks, they're ready and raring to get their refund as soon as humanly possible. For others, it's that moment when your boggart would turn into a year's worth of paperwork in folders, or a spreadsheet full of numbers (that's a Harry Potter reference, if you're bewildered already).

I'm here to answer some questions before you ask them - and maybe even to give you answers to questions you didn't even know you had! This is 10 things you should know about tax time:

1. You can lodge right now - yes, already!

ATO 2017 Tax Timeline

The ATO has released a timeline of their 2017 tax return processing schedule available here. My software has already released its 2017 tax return update, so if you have all your things together (see #4), you can lodge right now!

2. Refunds will be received from 18 July

The only catch with lodging right now? The ATO won't commit to issuing your refund until 18 July. From prior experience, this usually means that some of the early lodgers actually receive their refunds THAT DAY in their bank account - but odds are you won't see it before 18 July, even if you lodge tomorrow.

3. After 18 July, refunds will usually take about a week

The ATO has advised that their service standard for electronically lodged tax returns is 12 business days - this is in line with previous years.

What I've found through a lot of experience with tracking refunds is that the vast majority of refunds issue in a week - that is, if you lodge on a Thursday, you'll get your refund the next Thursday.

This is much more art than science, obviously, and you can't hold them to the 12 day standard as it's not a guarantee. But they do advise me of any clients who they expect will take over 30 days to finalise (and that's about 1% of my clients every year at most). Odds are you'll get your money much sooner than 12 days!

4. If you want to lodge early, you need these things

The bare bones of what you need to lodge are:

- PAYG Payment Summaries (Group Certificates) for all jobs where you got a payment between 1 July 2016 and 30 June 2017

- Interest income - a few cents on your main account doesn't matter, but if you have a savings account or a term deposit, you'll need to find the interest income

- Private Health Insurance - if you have this, they'll be sending you an Annual Tax Summary in early July. These are usually e-mailed out, and should also be available online

If you're not sure what else you might need, or what you might be eligible to claim, I've prepared a Tax Checklist - you can use the checklist to tick off what you have, what you still need to find, and what you don't need. Once you hit 'submit' it will e-mail you a copy of your answers so you can refer back or print them out!

5. If you're missing something, it's not the end of the world...eventually

If you've looked at #4 and thought to yourself that there's something in there that you have no hope in hell of getting - don't fret!

I know that sometimes life happens - maybe your old boss is not the best at making sure they get the information out to their employees when they're meant to, maybe you've moved house and you think something is sure to go missing.

The ATO has an excellent service called 'pre-filling'. As businesses send information to the ATO, it gets added to your own individual pre-filling report - this means that interest, dividends, payment summaries and private health information all eventually end up on a one-stop report.

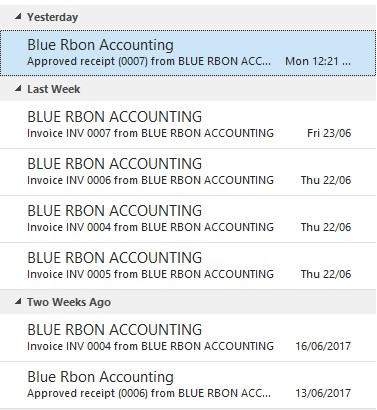

The ATO thinks that most information will be on the pre-filling report by early August. As you can see in the below example, the only information currently available is stuff direct from the ATO - nothing else has flowed through at this point.

ATO pre-filling is great! Just not until about August.

6. You can claim some deductions with no receipts at all

You're kidding, right? Free deductions from the ATO?

Not even joking. There's a few different ways you can claim deductions without any receipts.

- If you've seriously just got nothing at all - the ATO still allows you to claim $300 of deductions as a 'standard amount', with no receipts. This is a bare minimum that I throw into every tax return.

- If you have a uniform - even if your employer paid for it - you can claim up to $150 of laundry expenses. These expenses are claimable based on a reasonable estimate of total loads of laundry.

- If you use your mobile phone for work purposes (including calls, being 'on call', using your data for GPS, e-mail or research etc), you can claim a work-related percentage of your costs. Most people are on a phone plan or a standard rate each month, so calculating this is super easy.

- If you ever work from home, or even use your home internet for work purposes (including as Wifi for mobile phone usage), you can claim a percentage of your internet bill. If you have a specific home office (not just a couch), you can also claim 45 cents per hour of home office usage (to cover electricity and other costs).

- Saving the best for last - if you ever drive for work, you can claim up to 5,000 kilometres of work-related travel. This does not apply to home-to-work travel. But if you use your car at work to run errands, to drive between different shops or sites etc, you can claim your estimated work kilometres driven.

You can claim up to 5,000 kilometres this way, and the ATO rate is 66 cents per kilometre - the potential deduction can be thousands of dollars!

7. If you've lost your receipts, a bank statement will do

The ATO requires 'written evidence' of most of your deductions. Usually a receipt is the best way to keep this, but if you've lost your receipts you might still be able to grab your bank statement or credit card statement and highlight your deductions - the ATO accepts this as written evidence in many situations.

It might not work for deductions that are a bit vague - highlighting a payment to 'Woolworths' and saying that you bought office stationery might not be accepted, but a payment to 'Officeworks' probably would be.

Don't worry about your tax receipts - I've got a file full of them!

8. You can claim your tax agent fees

If you pay an accountant to do your tax return, you can claim that as a deduction on next year's return! If you come back to me next year, I put that in your return straight away. Even if you haven't kept my receipt, I still have copies of all of them too.

9. If you end up with a payable, you can delay your lodgement

If you get through the whole tax return process, and there's a surprise tax payable at the end of it (maybe a HECS/HELP mix up, maybe your small business is becoming a little less small!) - there's no requirement that you lodge it straight away. The ATO won't know about your tax payable until you officially submit the return.

You can wait until the due date to lodge, to give you time to save up if you need to.

If you lodge yourself, your due date will be 31 October 2017 - however if you lodge through me, your due date is extended - usually out to 15 May 2018. That's nearly a YEAR of extra time to save up the funds you need.

10. You can set up payment plans online - without having to talk to anyone

If you get to the due date, and life has got in the way of your savings, you can also set up a payment plan with the ATO - or I can set one up for you.

If you've connected your Tax File Number to myGov, you can sign in and set up the payment plan online. Otherwise, you can call up an automated 24/7 phone line. Either way, it's almost a certainty you won't have to speak to an actual person while setting up the payment plan!

There is one important thing - while you're on the payment plan, you must pay any future obligations in full by the due date. This includes pre-paid tax instalments (which will most often apply to small businesses), so you'll need to keep saving up to pay these instalments while you pay off the larger debt.

What do I do now?

If you're feeling a bit more prepared for tax time now, shoot me an e-mail and we can look at booking in an appointment, or sending through your documents for off site processing.

If you want to make sure you have everything you need, dive into my Checklist!

If you'd like to stay up to date with my articles for individuals, sign up to my Tax Return Newsletter.

No matter what you do this tax season - good luck! I promise it's not as scary as it might seem.